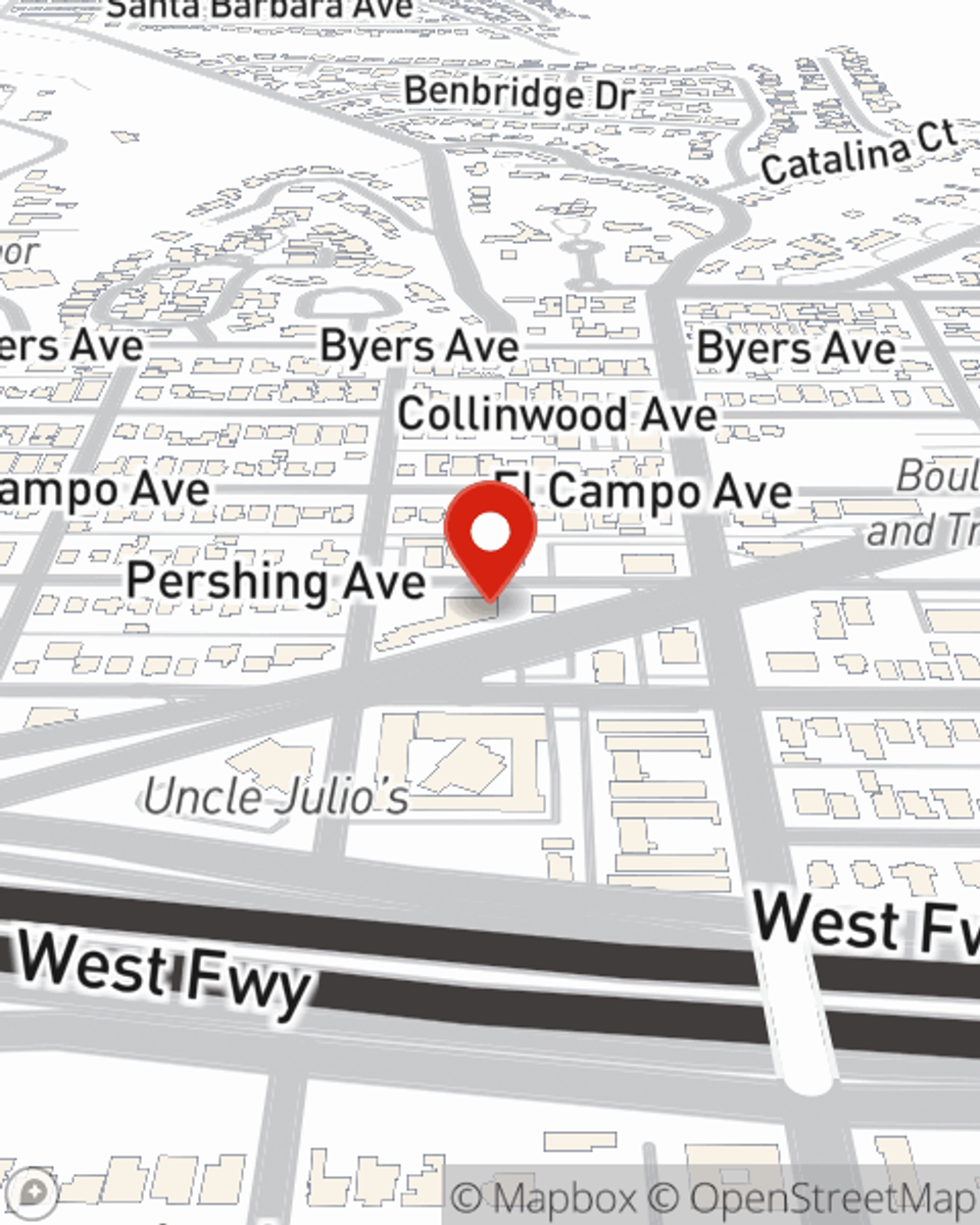

Business Insurance in and around Fort Worth

Calling all small business owners of Fort Worth!

Helping insure small businesses since 1935

Business Insurance At A Great Value!

Small business owners like you have a lot on your plate. From tech support to financial whiz, you do as much as possible each day to make your business a success. Are you a veterinarian, a taxidermist or an insurance agent? Do you own a book store, a beauty salon or a clothing store? Whatever you do, State Farm may have small business insurance to cover it.

Calling all small business owners of Fort Worth!

Helping insure small businesses since 1935

Insurance Designed For Small Business

Your small business is unique and faces specific challenges. Whether you are growing a book store or a beauty salon, State Farm provides a large range of small business insurance options to help your business thrive. Depending on your product, you may need more than just business property insurance. State Farm Agent Judy Samuel can help with extra liability coverage as well as commercial auto insurance.

With over 300+ businesses eligible to be insured by State Farm, look no further for your business coverage needs. Agent Judy Samuel is here to help you learn about your options. Get in touch today!

Simple Insights®

Importance of a business continuation plan

Importance of a business continuation plan

Find out why it's important to have a business succession plan in place before the time of death to benefit the surviving owners and heirs.

Checklist for apartment renting

Checklist for apartment renting

When finding an apartment, it’s important to know what to look for so you can make a smart assessment about each property you’re interested in.

Judy Samuel

State Farm® Insurance AgentSimple Insights®

Importance of a business continuation plan

Importance of a business continuation plan

Find out why it's important to have a business succession plan in place before the time of death to benefit the surviving owners and heirs.

Checklist for apartment renting

Checklist for apartment renting

When finding an apartment, it’s important to know what to look for so you can make a smart assessment about each property you’re interested in.